Over the years, young adults have continually disapproved of math curricula stressing theories and formulas rather than real-life knowledge such as understanding tax rates. In order for students to be successful, understand their pocket flow and prevent massive amounts of debt, a personal finance class should be required as a general education course at Kennesaw State.

Although many students may sulk at requiring additional classes, a finance class will create beneficial knowledge for the next generation of career-oriented adults.

“We need to learn how to save and how to invest,” junior international affairs major Amy Sangare said.

“The lack of financial literacy — just like the lack of a driver’s license — is more than a personal problem. It is dangerous for our country’s economic health,” according to Launch Phase 2. “The Great Recession was driven by mortgages and loan terms consumers didn’t understand.”

Students are graduating from college in more debt than before, and the number is rising. The Federal Reserve reported that the student loan debt reached $1.5 trillion in 2018, and, according to Student Loan Hero, 69 percent of college students in 2018 graduated with student loan debt. In comparison, only 12 percent of baby boomers have student loans either for themselves or for someone else, according to Jessica Dickler of CNBC.

Some college students today start buying their dream cars, moving into an apartments or adopting pets with no idea of how they will meet the financial end of the deal. In return, these students resort to living paycheck to paycheck and lowering their motivation to invest in anything that may benefit their future.

“It’s something you should learn rather than [being] thrown out into society not knowing anything and learn the hard way,” junior psychology major Bonnie Williams said.

“Even the most basic personal finance class could equip [students] with the skills they need to deal with a disappointing debt-to-income ratio,” according to an article published on Thrive by 30. “Instead of compounding that debt by purchasing items they do not need, they could focus on living meagerly until they found a better-paying position.”

With a mandatory finance class, students would be more aware of what items they are buying. Once that self-awareness is raised, all the money saved from avoiding the useless items could then be put in a rainy day savings account.

By teaching students to establish a rainy day fund, problems such as late cell phone bills, unpaid parking tickets or even emergency room visits could be covered without a sense of worry. Additionally, with the help of a finance class, students could learn how to start building credit with timely payments on their bills.

Once financial literacy is improved or understood more thoroughly, not only would it help the economy, but it can also help improve credit scores. By understanding how money works and how to keep it, a person may be able to show for it by buying their dream house or a nice personal car.

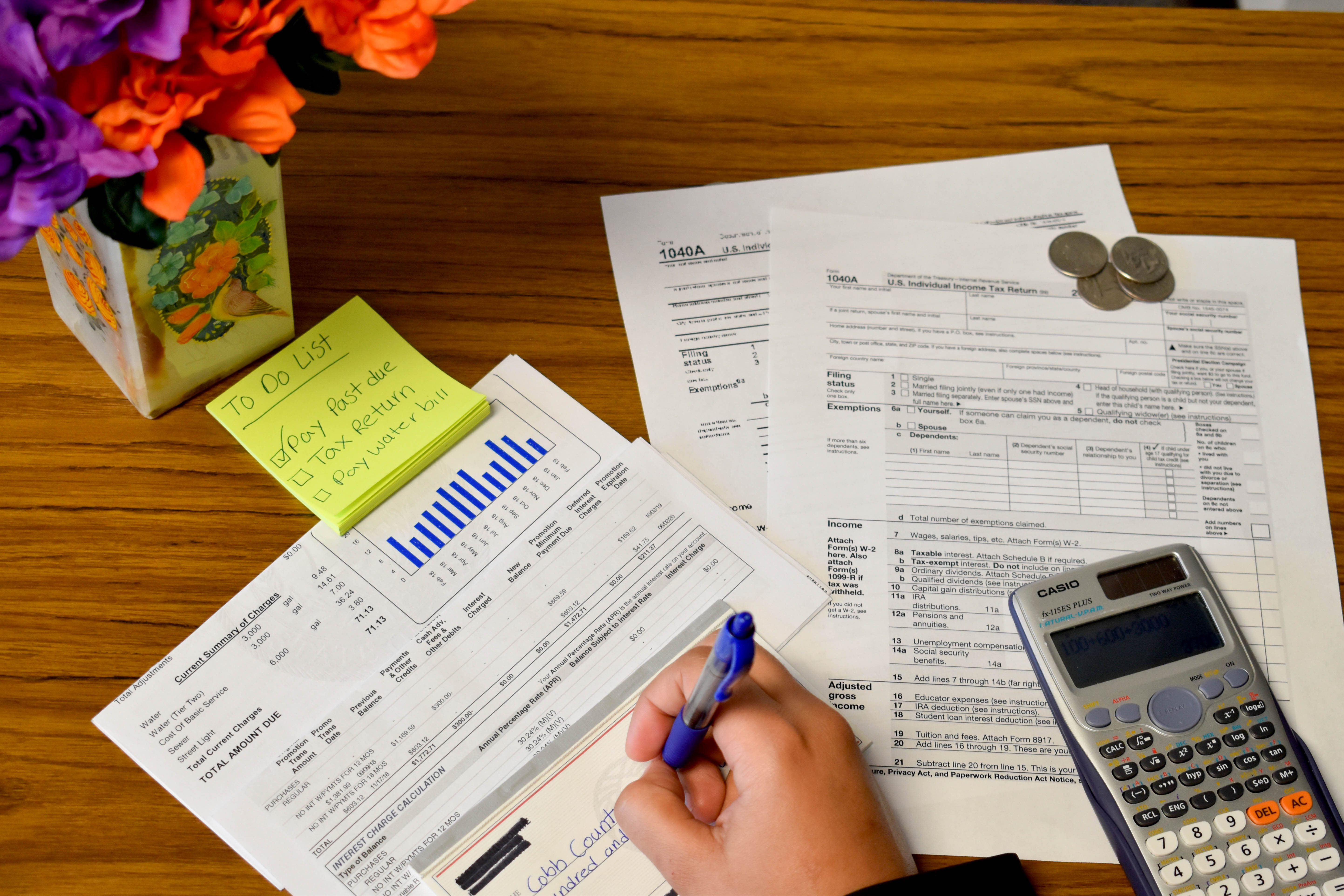

With a little bit of knowledge and education, many students would know what it means to break down certain aspects of finance, such as filing taxes. With more education comes improved financial responsibility and decision-making. By requiring students to take a financial class, students will be more aptly prepared for life after college.